Amazing! One word sums it all up for me. I am loving the DOL (Department of Labor) and Department of Labor rule on Fiduciary standard. The DOL has put in place a fiduciary standard for all retirement assets. What does this mean exactly, well not exactly.

Generally speaking a fiduciary standard is supposed to mean that the financial person you are working with is *supposed* to look out for your *best* interest. However, when a financial person is a registered representative or stock broker or insurance agent – the standard has not applied.

What, did you read that correctly, some financial people don’t have to put your interests first?

If what you thought to be true about your money wasn’t true, when would you like to know it was not true? Exactly, NOW!

Well, this new rule will cause many financial people to leave the industry – YEAH! The rule will also cause many to clean up their act. Even LPL in advance of the ruling cut the fees it charges clients… Hmm…

Resources

There are many great resources that you can get the *exact* details from, including the DOL’s own posting. (It is 208 pages)

What do you need to do

Pay attention to how your “financial advisor” responds to this rule. Are they upset? Do they have new forms for you to sign? Are they telling you to “ignore” the news and media play? I have a buddy who’s advisor told him he would be receiving a letter – and to discard the letter. Pay no attention to the letter.

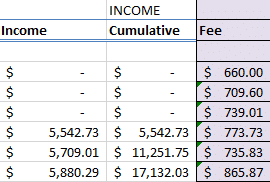

If you would like a second opinion about your situation, a cursory review, we can help you with that. Our standard, all in planning package can be as much as $15,000 (most are around $3,500). This might seem like too much to some people. However, if you were to find out that your hidden fees were $3,000-$5,000 per year per $100,000 you have in a Variable Annuity – well, let’s say our pricing is the best money you will have ever spent.

Here is the deal – Tell us that you are calling about our DOL review offer. We will able to reduce our fee to $3,500 for the review process. Our full-blown financial plan is based on the amount of work, which is different than reviewing your current situation, products and investments.