Let me start with I know ‘Big Joe’ Clark from my Ed Slott Master Elite Training. Joe is one of the founding members of the group. I have nothing bad to say about Joe.

That said, Joe recently published an article that I see issues in or perhaps there is a lack of understanding. The article is titled, “What to know about equity index annuities.”

In this article Joe mentions a few issues he sees with Equity Index Annuities AKA Fixed Index Annuities, FIA, and EIA.

Joe touches on fees, promises, risk, real return, among other issues.

I realize Joe does not know the inner workings of these products. He seems to have a bad taste in his mouth from some of the evil annuity sales people. There are clearly evil annuity sales people. I caution people to throw the baby out with the bath water.

I personally don’t use Fixed Index Annuities for growth. My main purpose for ever using a FIA is for the future income it can provide.

Back to Joe’s article. Joe says surrender charges are fees. Well, if the annuity sales person Joe speaks of did not perform their job well then a surrender charge may be incurred. When I hear fees I think of management fees for assets. When I hear fees associated with annuities people are usually talking about Variable Annuities, which can have as high as 3-5% in fees.

Fixed Index Annuities are different. They aren’t easy to understand and that alone can be frustrating to some. When I first got into this business I created a spreadsheet to model the most basic crediting strategy. Basically, I reverse engineered the thing.

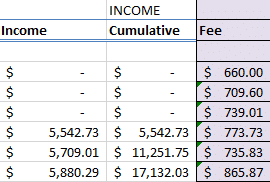

Then comes income planning – guarantees from the life insurance company through something called an income rider. These were great, growing money at a set and guaranteed rate for future income. I could calculate to the dime what income would be on any date in the future.

Real Return – I don’t care, this not why I ever use an index annuity. If someone needs something more than future income, such as growth, I would opt for Joe’s asset management, not an FIA.

Finally, risk. Risk exists everywhere, from getting out of bed to taking a shower. I never say an annuity is free of risk. I will state that in my opinion a fixed index annuity has substantially less risk than investing in the stock market.

Big Joe – I love you! I learn much from you and wish I could sit in your classes as I bet I’d learn even more.