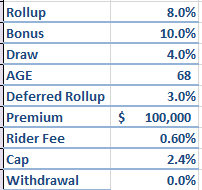

Jackson National Life Insurance Company has introduced a new income rider. The income rider can be attached or added to their Fixed Index Annuity, the Jackson AscednerPlus Select.

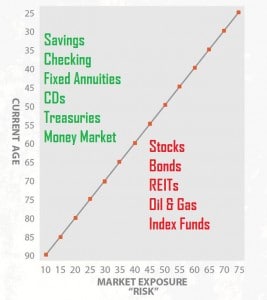

For those who don’t yet know what an income rider is, it is a feature set that can be added to an annuity or may be integrated into an annuity. This annuity I am speaking of is called a Fixed Indexed Annuity. This is type of annuity protects the clients premium from market losses. For the most part the only way a Fixed Indexed Annuity can lose money is by the owner surrendering the policy and incurring a surrender charge. If a client has to surrender a policy it would imply that the original plan for the annuity may not have been solid or life’s challenges forced someone’s hand.

There is a full article for your consideration on MarketWatch.com

If you are considering an annuity or if you have already purchased an annuity, consider getting a second opinion. We can provide an objective analysis of annuities, show the features that work for you and point out areas to be aware of.

Simply fill out the contact form below and we’ll get back in touch with you

If they want to ensure they never run out of money, this *might* fit. It is likely that another annuity will be a much better fit. Then the question becomes, which annuity is best. Well, that depends on several factors. W use something sophisticated, it is called math & logic, to analyze what is the best fit for each client. Call and ask to speak with one of our annuity analysts. We don’t share nor sell your information – you will only ever have one person to speak with from our company.

If they want to ensure they never run out of money, this *might* fit. It is likely that another annuity will be a much better fit. Then the question becomes, which annuity is best. Well, that depends on several factors. W use something sophisticated, it is called math & logic, to analyze what is the best fit for each client. Call and ask to speak with one of our annuity analysts. We don’t share nor sell your information – you will only ever have one person to speak with from our company.